property tax in france 2019

Progressive scale 75 or 172. The planned measures will see an initial 30 reduction in your residential tax bill from November 2018.

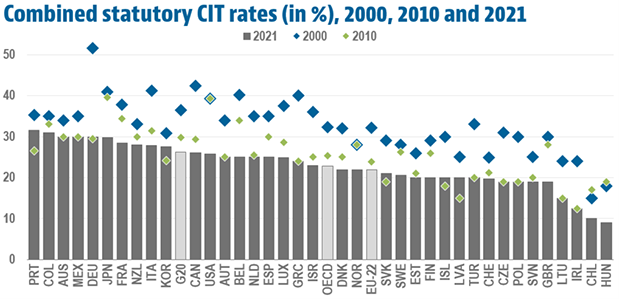

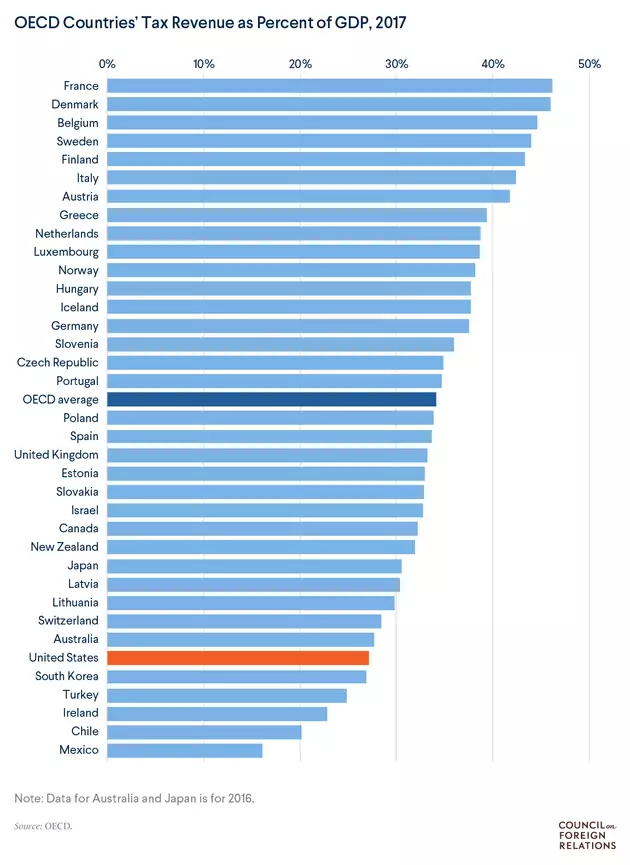

List Of Countries By Tax Rates Wikipedia

So the difference between the price you bought it for and the price you sell it for.

. 362 or 265 additional tax 2 to 6 if CG 50000. The 2019 budget proposal released yesterday by Finance Minister Bruno Le Maire highlights that the proposals will lead to 26 billion 306 billion USD in tax cuts. Taxe Total tax revenue.

Any person living abroad and owner of real estate in France is subject to French property tax. Together these taxes are the equivalent to UK Council Tax. 0 - 971000 0.

So if youre selling a. 38 rows Elke Asen. The main two taxes in France for property are the taxe foncière and the taxe dhabitation.

Below you will find the personal income brackets in France and the relevant taxable amount and how much of this your gross salary is subject to. French property tax. Still for a 15 million US17 million home a resident could expect to pay about 6000 to 8000 in annual taxes according to Jack Harris an associate with the International.

An additional tax is applicable on real estate capital gains exceeding. A total of 362 including special social surtaxes of 172. There is no exemption.

Under the family coefficient system the income brackets to which the tax rates apply are determined by dividing taxable income by the number of allowances available to an individual. In France there are three categories of taxes on income. Here is how it is calculated.

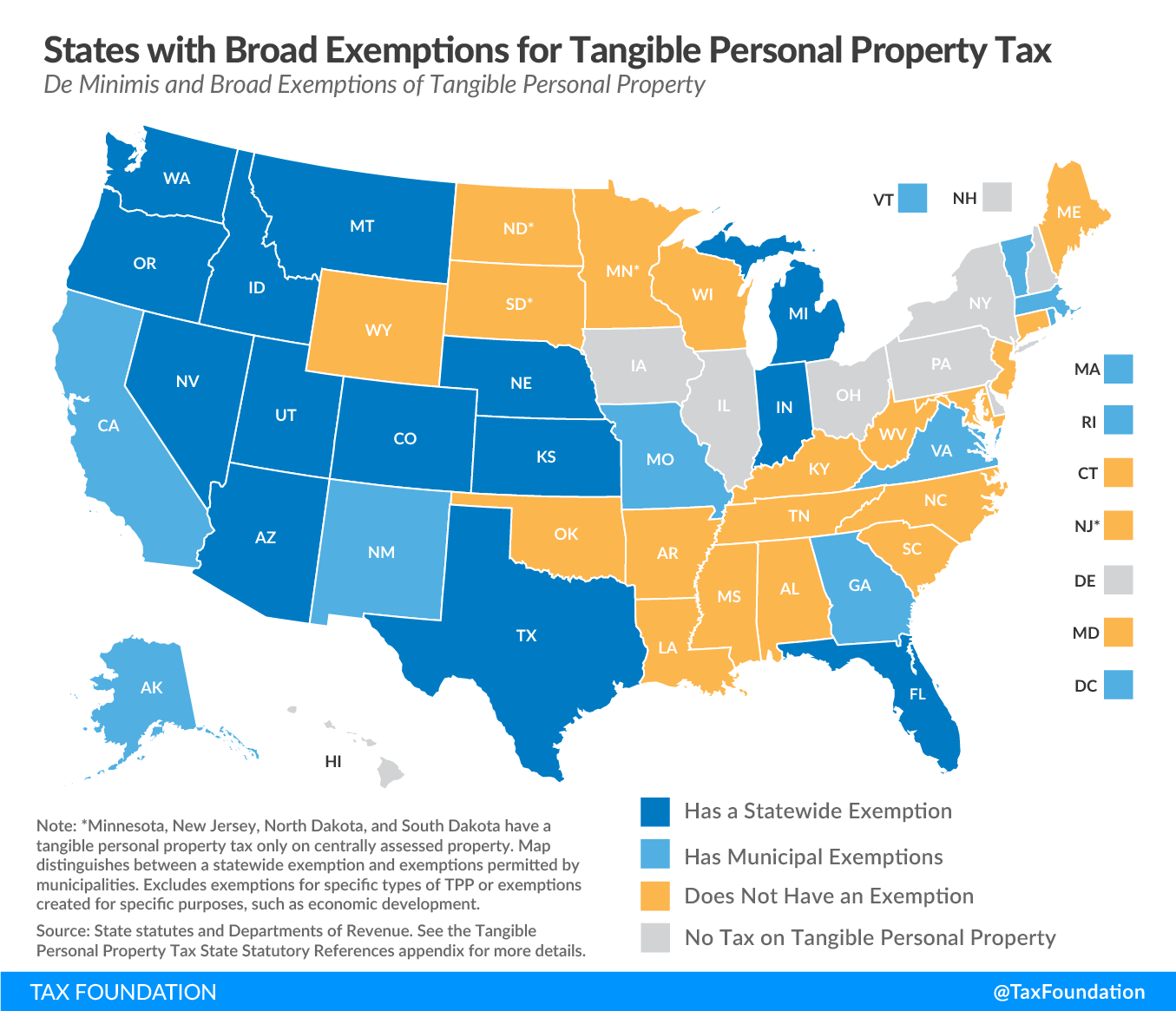

The two main property taxes are. To be eligible your income must not exceed a certain threshold then you will benefit. Todays map shows how European OECD countries rank on property tax es continuing our series on the component rankings of the 2019 International Tax.

Taxe foncière Land Tax Taxe dhabitation Housing or Residence Tax There are currently reforms underway to abolish the Taxe. The net gain is taxed at a flat rate of 19 ie. Its made up of a flat income tax rate of 19 plus 172 in social charges.

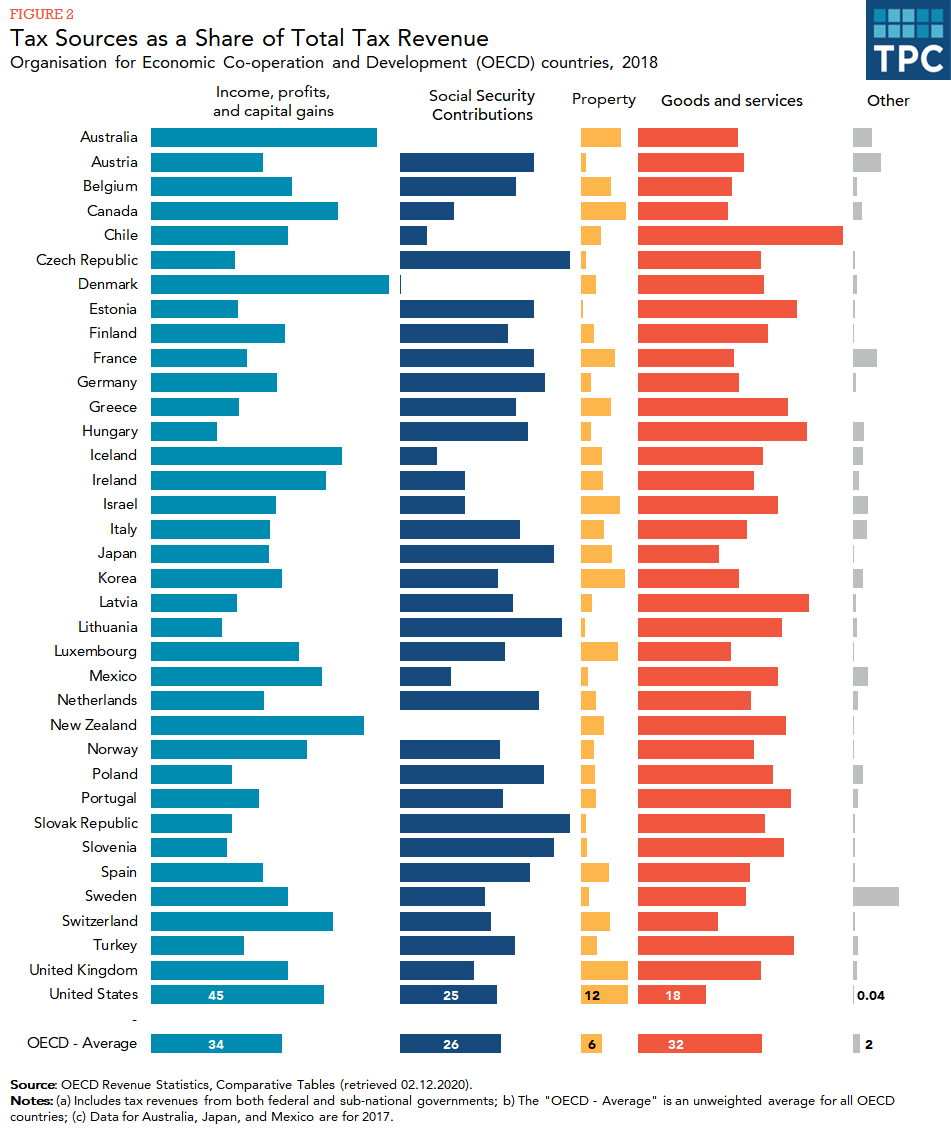

Any owner of real estate in France on 1 st. The corporate tax the income tax for individuals and taxes for social purposes CSG and the CRDS paid by the.

The Problem With France S Plan To Tax Digital Companies

How Do Us Taxes Compare Internationally Tax Policy Center

7 504 French Property Images Stock Photos Vectors Shutterstock

French Taxes I Buy A Property In France What Taxes Should I Pay

Capital Gains Tax In France On Property Blevins Franks Advice

Homeowners In France Hit By Tax Rise Shock

Taxes On Real Estate In France On The Purchase Maintenance Accommodation Sale For Citizens And Residents Hermitage Riviera

Legal Advice Property Tax In France Aix En Provence Marseille Cm Tax

This Is How The World S High Tax Countries Do It Treasury Risk

Selling A Property In France Here S What You Need To Know About Paying Capital Gains Tax The Alliance Of International Property Owners

What Do French Tax Law Changes Mean For Expats International Adviser

Levying The Land The Economist

Paying Property Tax In France Here S Your 2017 2018 Guide Wise Formerly Transferwise

9 Tips On How You Can Minimize Risks When Buying An Untitled Property In The Philippines The French Adobo

Inequality And Tax Rates A Global Comparison Council On Foreign Relations

Opinion How Lower Income Americans Get Cheated On Property Taxes The New York Times

In Tax Gender Blind Is Not Gender Neutral Why Tax Policy Responses To Covid 19 Must Consider Women Ecoscope

Property Taxes Global Living 2019 Cbre Residential Cbre Residential